Over the past few years we have had to take some difficult decisions on the economy to help support people  and businesses

and businesses  through the pandemic and the rise in global energy prices. In your pay cheque last week you will have seen an extra £37.

through the pandemic and the rise in global energy prices. In your pay cheque last week you will have seen an extra £37.

Local residents often tell me that they feel that the tax burden is simply too high  . I get it. I have been pushing every door

. I get it. I have been pushing every door  and banging every drum

and banging every drum  and we are now in a position to change gears and cut

and we are now in a position to change gears and cut  taxes - putting more money in people's pockets

taxes - putting more money in people's pockets  . Inflation has been halved and the economy is recovering from the pandemic.

. Inflation has been halved and the economy is recovering from the pandemic.

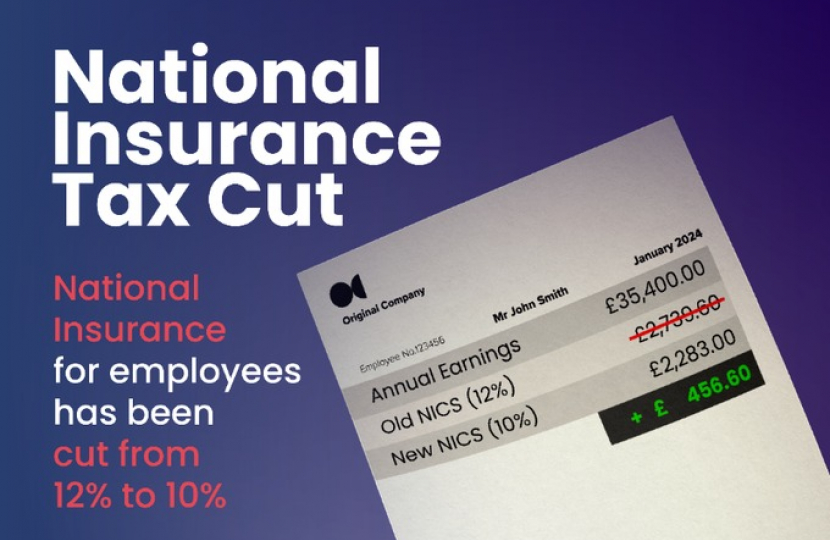

We are now able to cut taxes and our cut to National Insurance has come into effect.

What does this mean for me?

What does this mean for me?

This cut will save the average salaried worker on £35,400 - £450 this year. An average full-time nurse

This cut will save the average salaried worker on £35,400 - £450 this year. An average full-time nurse  will save £520, a typical junior doctor

will save £520, a typical junior doctor  £750 and a teacher

£750 and a teacher  £630.

£630.

HMRC have set up a dedicated tool which you can use to estimate how the January 2024 tax cut will help you  http://tinyurl.com/57923yy5

http://tinyurl.com/57923yy5